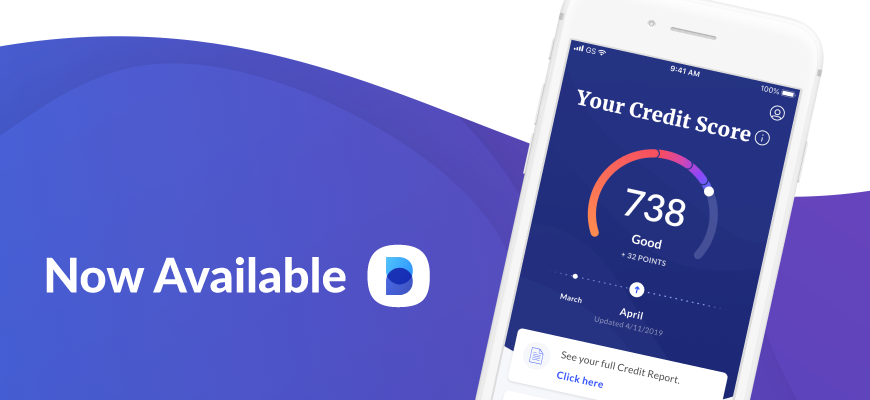

In today’s digital age, understanding and managing your credit score has never been more critical. Borrowell emerges as a beacon of hope for Canadians nationwide, offering a revolutionary approach to credit education. With a commitment to empowering individuals through financial knowledge, Borrowell provides tools and insights to help you navigate the complex world of credit scores and reports.

Borrowell: Empowering Canadians with Free Credit Scores

Borrowell’s journey began with a simple yet groundbreaking idea: to provide Canadians with free, easy access to their credit scores. This initiative was a first in Canada, revolutionizing how Canadians interact with their financial data. Today, Borrowell proudly serves over 3 million members, offering more than just credit scores; it’s a comprehensive platform for financial wellness.

Why Canadians Trust Borrowell

Borrowell’s popularity doesn’t just stem from its free services. Here are the top reasons why it’s become a household name:

- Weekly Updates: Stay on top of your financial health with free weekly credit score and report monitoring.

- Security: Bank-level encryption ensures your data is protected at all times.

- Personalized Recommendations: Receive suggestions for financial products tailored to your credit profile.

- Credit Improvement Tips: Leverage expert advice to enhance your credit score.

- No Impact on Your Score: Checking your score with Borrowell won’t dent your credit.

How Borrowell Nurtures Your Financial Growth

Borrowell’s approach to financial education is holistic. It starts with providing free access to your Equifax credit score and report, updated on a weekly basis. But it doesn’t stop there. Borrowell’s AI-powered Credit Coach dives deep into your credit profile, offering personalized tips to improve your score. Additionally, the platform compares financial products from over 75 partners, helping you make informed decisions that align with your credit health.

Your Financial Goals, Simplified

Whether you’re aiming to get a loan, find the perfect credit card, or secure a mortgage with competitive rates, Borrowell lays out the path for achieving your financial objectives. By comparing products across various partners, Borrowell simplifies the process of finding what works best for you, all based on your unique credit profile.

Is Borrowell Truly Free?

Yes, it genuinely is. Borrowell’s innovative model provides you with essential financial tools at no cost. The platform earns through partner recommendations, but the choice to explore these suggestions is entirely yours. This user-centric approach is why millions continue to trust and rely on Borrowell for their credit and financial needs.

Embrace a future where financial wellness is accessible to all. With Borrowell, you gain not just a service, but a partner dedicated to helping you achieve your financial dreams. Sign up today and be part of a community that’s shaping the future of financial health in Canada.