Running a business is no small feat, and managing finances can often feel like a job in itself. Whether you’re a freelancer, entrepreneur, or small business owner, you’ve likely faced the headache of clunky banking systems, slow processes, and hidden fees. Enter Qonto, the modern solution to business banking that’s fast, user-friendly, and tailor-made for today’s professionals.

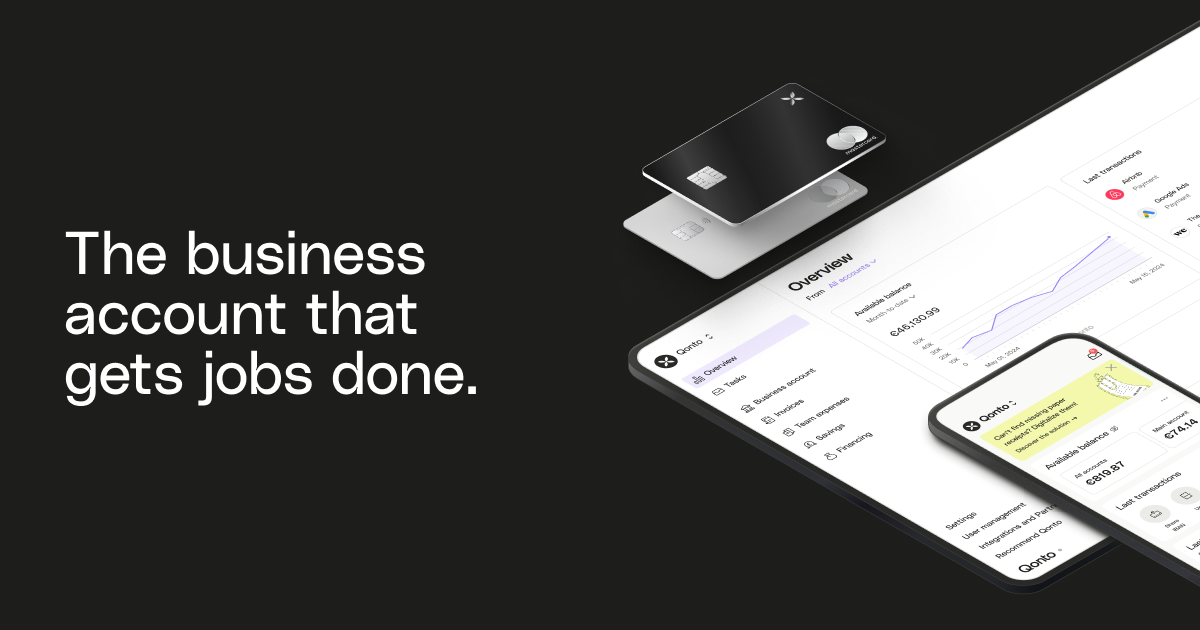

Qonto is more than just a bank account—it’s a streamlined financial hub designed to help businesses focus on growth while simplifying day-to-day banking and administrative tasks. From efficient expense management to effortless invoicing and team-friendly banking tools, Qonto has redefined what modern business banking looks like. Ready to take a closer look at how Qonto can change the game for your business? Let’s explore!

A Business Account Designed for Real-Life Needs

One of Qonto’s standout features is its business-first approach. Unlike traditional banks that often feel generic, Qonto offers banking services specifically built to meet the needs of freelancers, startups, and SMEs. Whether you’re managing cash flow, paying suppliers, or keeping track of expenses, Qonto makes it all as smooth as possible.

Signing up is incredibly fast and fully online—no waiting in lines or dealing with piles of paperwork. With a sleek, intuitive interface, you can manage your finances from your laptop or phone in just a few clicks. From opening a business account to setting up team roles and permissions, Qonto provides a modern banking experience designed to save you time and effort.

Simplified Expense Management at Your Fingertips

Let’s face it—expense management can quickly spiral out of control, especially if you’re juggling multiple transactions, team expenses, and receipts. Qonto solves this problem with a user-friendly expense management system that makes tracking and categorizing spending effortless.

With Qonto’s tools, you can:

- Automatically capture and organize receipts with a simple photo upload.

- Tag and categorize expenses for clearer financial insights.

- Assign team-specific cards with spending limits to keep budgets under control.

Gone are the days of manually sorting through crumpled receipts and spreadsheets. Qonto ensures everything is organized, transparent, and accessible in one place, helping you stay on top of your finances without the stress.

Smart Business Tools That Keep Your Team Connected

Qonto understands that modern businesses rely on collaboration, which is why they’ve built a suite of team-friendly tools that make shared financial management simple. You can invite team members, assign roles, and set customized access permissions so that everyone has exactly what they need (and nothing they don’t).

Qonto’s physical and virtual payment cards are a game-changer for team spending. Create individual cards for employees, set budgets, and monitor spending in real-time. Whether you’re managing a team of 2 or 20, Qonto makes sure expenses are transparent and under control. Need an extra layer of security? You can block or freeze cards instantly if needed.

Invoices, Payments, and Transfers Made Effortless

One of Qonto’s best features is its ability to simplify your cash flow processes with easy tools for invoicing, payments, and transfers. As a business owner, sending and managing invoices can be time-consuming, but Qonto allows you to create, customize, and send professional invoices directly from your account. Even better? You’ll get notified as soon as your payments land, so you’re never left guessing.

For payments, Qonto supports SEPA transfers, international payments, and bulk transactions, making it easier to pay suppliers, team members, or bills. The automated tracking system keeps a record of every transaction, ensuring you always know where your money is going. No more messy records or missed payments—Qonto keeps everything running smoothly.

Integrated Tools for Smarter Financial Management

Qonto doesn’t just stop at banking—it seamlessly integrates with popular accounting software and financial tools to give you a complete picture of your business finances. Whether you use QuickBooks, Xero, or another accounting tool, Qonto’s integrations ensure your data flows effortlessly between platforms.

This saves you hours of manual work and reduces the risk of errors. Exporting financial reports, reconciling transactions, and preparing for tax season becomes faster and more accurate. Qonto even offers automated VAT tracking, helping you stay compliant without the usual headaches.

Transparency and Fair Pricing: No Hidden Fees

Tired of dealing with hidden banking fees that creep up out of nowhere? Qonto operates with transparent pricing that gives you full clarity on what you’re paying for. They offer multiple pricing plans, so whether you’re a freelancer, startup, or growing SME, there’s a plan that fits your needs perfectly.

Qonto’s flat-rate pricing ensures there are no surprises, and you can scale up or down as your business evolves. Each plan comes with a robust set of features, including multi-user access, expense tools, and payment card options, meaning you’re always getting great value for your money.

Security You Can Trust

When it comes to banking, security is non-negotiable, and Qonto takes this seriously. Your funds are protected, and your data is encrypted using bank-level security standards. Qonto’s platform is compliant with financial regulations, giving you peace of mind knowing that your business finances are in safe hands.

You also have full control over your accounts and cards, with features like two-factor authentication, instant card freezing, and secure transaction notifications. Whether you’re in the office or on the go, Qonto keeps your finances secure at all times.

Why Businesses Love Qonto

Qonto has quickly become a favorite for freelancers, entrepreneurs, and small businesses for all the right reasons:

- Easy Setup: Fully online, quick, and hassle-free account creation.

- Time-Saving Features: Streamlined invoicing, expense tracking, and payment tools.

- Team-Friendly Tools: Payment cards, role-based access, and real-time monitoring.

- Smart Integrations: Sync with accounting software for effortless financial management.

- Transparent Pricing: Clear, affordable plans with no hidden fees.

Qonto is more than just a bank; it’s a financial partner that helps businesses run smoother, faster, and smarter. By offering modern tools, flexible features, and a user-friendly platform, Qonto empowers you to spend less time on admin and more time growing your business.

Simplify Your Business Banking with Qonto Today

If you’re ready to say goodbye to traditional banking headaches and hello to streamlined, efficient financial management, Qonto is the solution you’ve been waiting for. Whether you’re a freelancer looking for simplicity, a small business managing a team, or a startup scaling fast, Qonto has the tools you need to thrive.

Explore Qonto’s features, pick a plan that works for you, and join the thousands of businesses already experiencing the future of modern banking. Your time is valuable—let Qonto help you make the most of it.