Building credit is one of the most crucial steps toward financial freedom, yet it can often feel like a confusing and overwhelming process. That’s where Kikoff comes in, revolutionizing the way people establish and improve their credit scores. Whether you’re starting from scratch or working to recover from past financial mistakes, Kikoff offers a simple, affordable, and effective solution to take control of your credit journey. Let’s dive into what makes Kikoff a standout platform for credit building and how it can help secure your financial future.

The Challenge of Building Credit

For many people, building credit feels like a catch-22. You need credit to qualify for loans, rentals, and credit cards, but how do you get credit without already having a credit history? Kikoff understands this dilemma and provides a smart, beginner-friendly way to establish or improve your credit score without the traditional hurdles.

Unlike traditional methods that require high fees or expensive credit-building products, Kikoff is designed with simplicity and accessibility in mind. It’s perfect for students, recent grads, or anyone looking for a fresh financial start.

How Kikoff Works

Kikoff’s approach to credit building is refreshingly straightforward. When you sign up, you’re provided with a Kikoff Credit Account that helps you establish positive payment history—one of the most significant factors in your credit score. Here’s a step-by-step breakdown of how it works:

- Sign Up: The process is quick and hassle-free, with no credit check required.

- Activate Your Account: After signing up, you’ll gain access to a line of credit that’s reported to major credit bureaus.

- Make On-Time Payments: By making small, manageable payments each month, you demonstrate consistent financial responsibility.

- Build Credit History: Kikoff reports your payment activity to the credit bureaus, helping to improve your score over time.

It’s as simple as that! No hidden fees, no high-interest rates—just a straightforward path to better credit.

Why Choose Kikoff?

With so many credit-building tools and services available, why should Kikoff be your go-to? The answer lies in its affordability, transparency, and effectiveness. Here’s what makes Kikoff unique:

- No Hard Credit Check: Unlike traditional lenders, Kikoff doesn’t require a credit check to get started, making it accessible to everyone.

- Low Cost: Kikoff’s pricing is refreshingly affordable, with plans that don’t break the bank.

- Fast Results: Many users report seeing improvements in their credit scores within just a few months.

- Transparency: There are no hidden fees or confusing terms. What you see is what you get.

- Beginner-Friendly: Whether you’re completely new to credit or looking for a simple way to boost your score, Kikoff’s platform is easy to use and understand.

Features That Set Kikoff Apart

Kikoff doesn’t just help you build credit—it also provides tools and resources to improve your overall financial literacy. Here are some of the standout features:

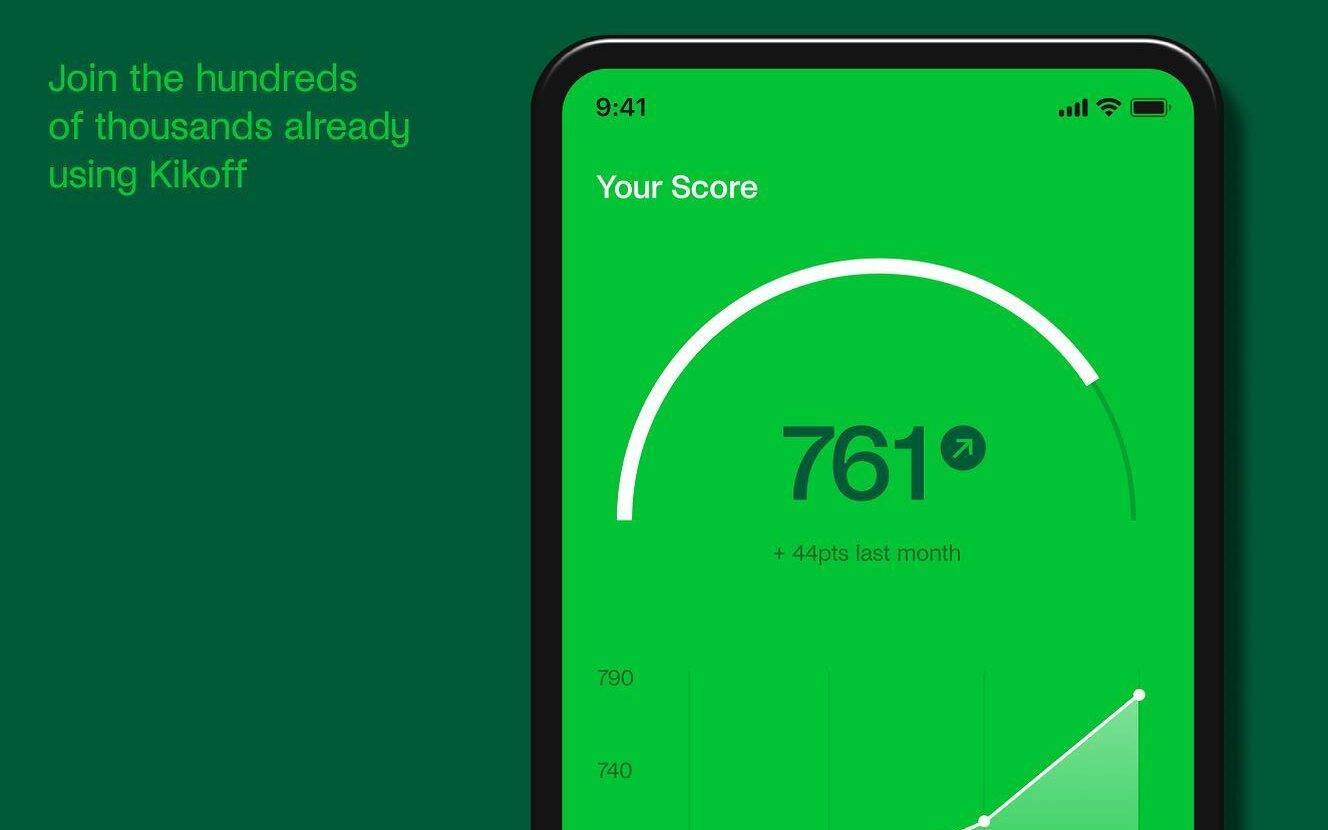

- Credit Dashboard: Stay on top of your progress with an intuitive dashboard that tracks your credit-building journey.

- Educational Resources: Access articles, tips, and insights to learn more about managing your finances and making smarter financial decisions.

- Flexibility: Kikoff’s low-cost approach means you can build credit without straining your budget.

- No Risk of Overspending: Unlike traditional credit cards, Kikoff’s structured system ensures you only spend what you can manage, preventing the risk of accumulating debt.

These features make Kikoff more than just a credit-building tool—it’s a comprehensive financial wellness platform.

Perfect for Students and Young Professionals

One of Kikoff’s biggest advantages is its appeal to younger users who are just starting their financial journeys. For students and recent graduates, establishing credit is essential for renting apartments, buying cars, and eventually purchasing homes. Kikoff provides a no-risk way to start building credit early, giving users a financial edge as they enter the workforce.

Additionally, Kikoff’s educational content is tailored to help young people make informed financial decisions, ensuring they develop healthy habits from the start.

Affordable Credit Building for Everyone

Credit-building tools often come with steep fees or require significant upfront costs, but Kikoff breaks the mold with its low-cost model. For just a few dollars a month, users can access everything they need to improve their credit score without taking on financial stress.

This affordability ensures that Kikoff is accessible to people from all walks of life, making it an excellent choice for anyone looking to improve their credit without high costs or complex terms.

How Kikoff Supports Your Financial Goals

Good credit is the key to unlocking countless opportunities, from securing loans with lower interest rates to qualifying for better credit cards and rental agreements. Kikoff’s tools and resources are designed to help you achieve these goals, opening doors to financial independence and security.

By focusing on positive payment history and financial education, Kikoff ensures that users not only improve their credit scores but also gain the knowledge needed to maintain good credit for years to come.

What Users Are Saying

Kikoff’s success stories speak for themselves. Users rave about how easy and effective the platform is for improving their credit scores. Many appreciate the simplicity of the process, while others highlight the value of the educational content.

From students building credit for the first time to individuals recovering from past financial struggles, Kikoff has helped thousands of users take control of their credit and achieve their financial dreams.

Ready to Kick Off Your Credit Journey?

If you’re ready to take charge of your financial future, Kikoff is here to help. With its affordable pricing, beginner-friendly tools, and proven results, it’s never been easier to start building or improving your credit score.

Visit their website today to learn more and start your journey toward better credit. Your future self will thank you!